Volatility Diagnostics for Stock Price of Sharia-Compliant Companies listed in Malaysia Composite Index( Vol-5,Issue-2,February 2019 ) |

|

Author(s): Nashirah Abu Bakar, Sofian Rosbi |

|

Keywords: |

|

|

Volatility, Sharia-compliant companies, Malaysia Stock Exchange, Kuala Lumpur Composite Index, Islamic Finance. |

|

Abstract: |

|

|

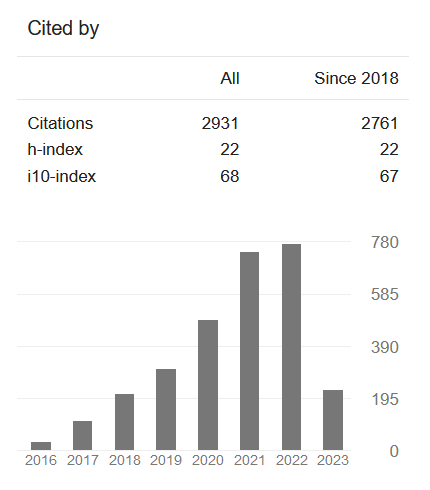

The objective of this study is to evaluate the volatility of sharia-compliant companies that listed on Malaysia Stock Exchange. Data of return for each of the companies are collected from Thomson Reuters Datastream. The number of selected companies is 19 that selected from 30 companies composing Kuala Lumpur Composite Index (KLCI). This study calculated average monthly return and volatility rate for each of the companies. Next, normality statistical test is performed using Shapiro-Wilk normality test. Result indicates the mean value of average monthly return is 0.442 % with standard deviation 1.28%. Then, the mean value for volatility rate is 4.85% and standard deviation is 2.23%. Result from Shapiro-Wilk normality test indicates data distribution for average monthly return and volatility follow normal data distribution. The significant of these findings is it will help investors to understand the behavior of stock price in Malaysia Stock Exchange particularly sharia-compliant companies in Kuala Lumpur Composite Index. In addition, the findings of this study will help investors to develop investment portfolio that can maximize return and reducing loss. |

|

Cite This Article: |

|

| Show All (MLA | APA | Chicago | Harvard | IEEE | Bibtex) | |

Share: |

|

DOI:

DOI: